2026 IRS Refund Timeline Update: When Deposits May Arrive, How to Get Paid Faster, and What Filers Must Know

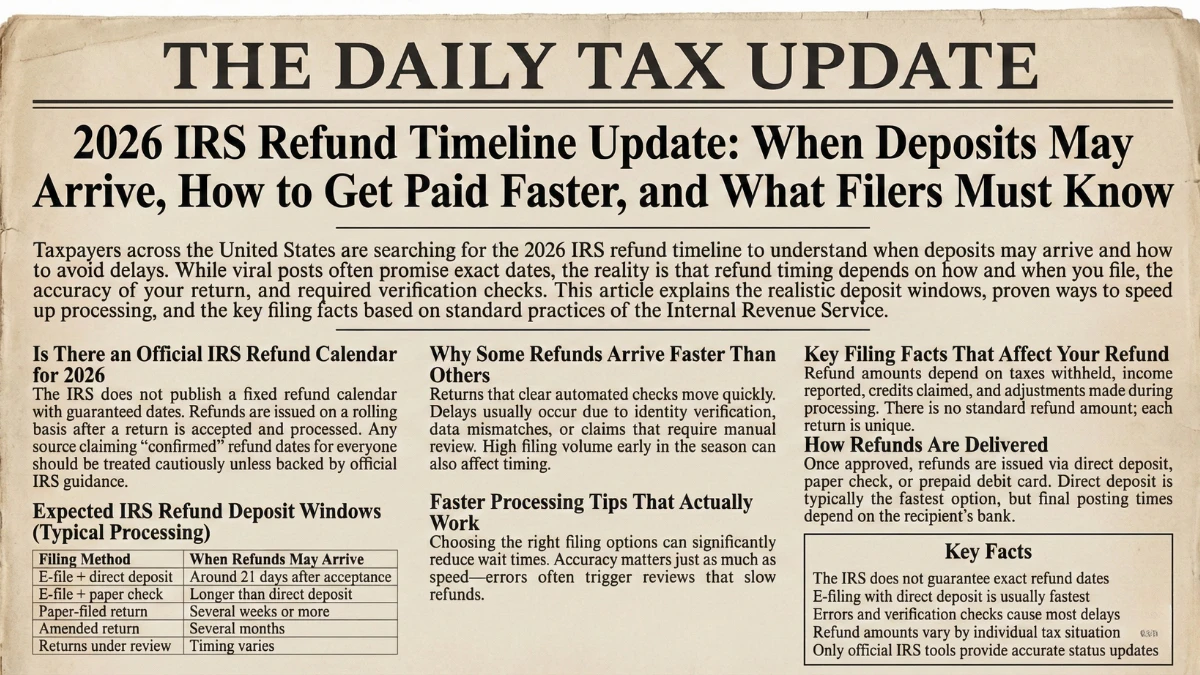

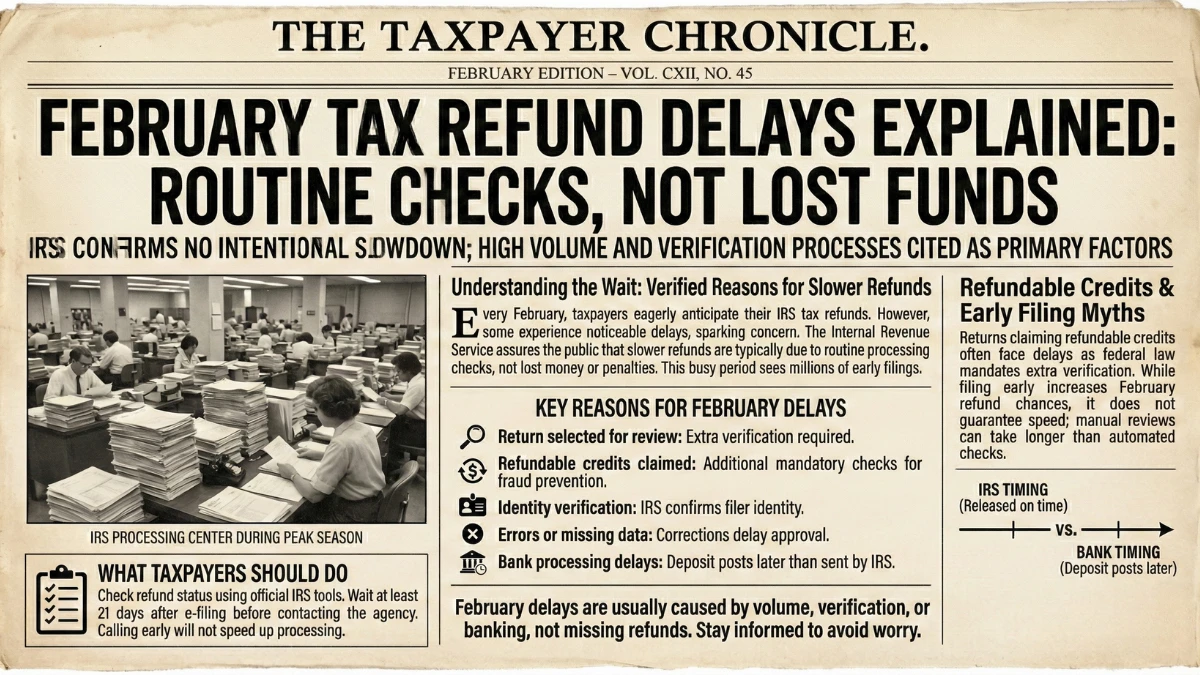

Taxpayers across the United States are searching for the 2026 IRS refund timeline to understand when deposits may arrive and how to avoid delays. While viral posts often promise exact dates, the reality is that refund timing depends on how and when you file, the accuracy of your return, and required verification checks. This article … Read more